Let’s say your business is humming along—you’ve got steady revenue, a solid team, and big plans ahead. Maybe it’s time to bid on larger projects, open a new location, or expand your service offerings. Exciting stuff! But here’s the million-dollar question (sometimes literally): Do you have the working capital to make it happen?

At BusinessFunds.com, we connect ambitious business owners like you with tailored loan solutions that fuel growth without the fluff. So, let’s break down why working capital is more than just a financial buzzword—it’s the fuel behind your expansion engine.

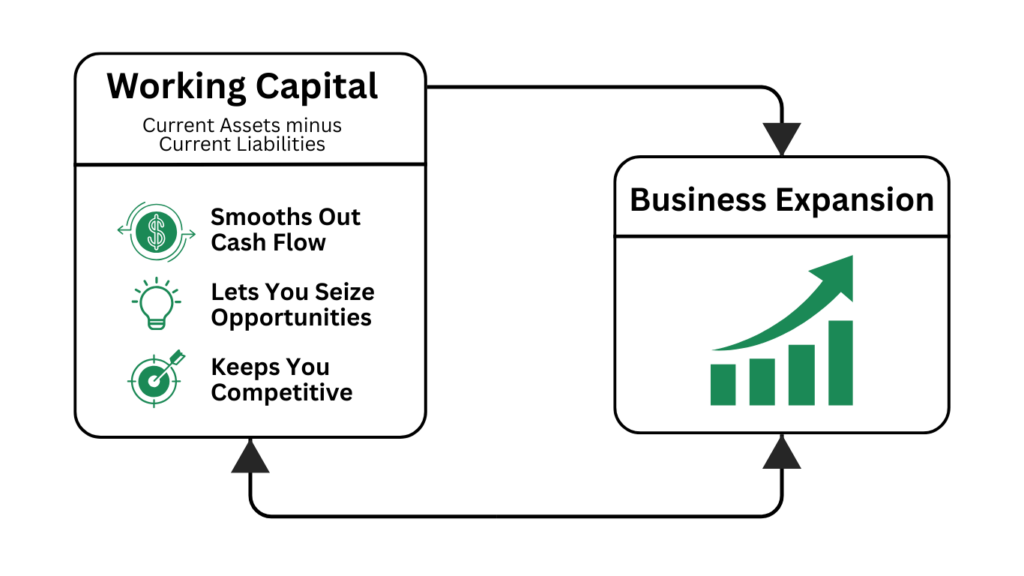

What is Working Capital, Really?

Let’s keep it simple. Working capital is the difference between your current assets (like cash, accounts receivable, and inventory) and your current liabilities (like payroll, rent, and vendor payments). It’s what’s left over to keep the day-to-day operations running—and it plays a huge role when you’re planning to scale.

Think of working capital as the air in your business lungs. You don’t notice it when everything’s fine, but the minute you run out, it becomes all you can think about.

Expansion Isn’t Just About Vision—It’s About Execution

Having a great plan to grow your business is a start—but executing that plan requires flexibility, fast access to funds, and financial breathing room. That’s where working capital steps in.

Here’s how working capital directly supports business expansion:

1. Smooths Out Cash Flow During Growth Spurts

Growth is rarely a straight line. You may win a big contract that demands you hire more staff, rent additional equipment, or increase inventory—before you get paid.

- Construction firms, for example, often need to front labor and material costs for projects that pay out months later.

- Medical practices expanding into new facilities face upfront costs for equipment, staffing, and compliance.

Having sufficient working capital ensures your business keeps running smoothly without turning every invoice delay into a panic attack.

2. Lets You Seize New Opportunities—Fast

Ever found the perfect property for a new location or had the chance to stock up on discounted inventory? These opportunities are fleeting. You need funds ready to go—not a weeks-long approval process from a traditional bank.

Working capital gives you the financial agility to move when the moment’s right. Whether that’s hiring a top-tier project manager or investing in a time-saving software system, quick access to funds can give you a real competitive edge.

3. Keeps You Competitive Without Cutting Corners

Growth often means beefing up operations, improving customer experience, or outpacing competitors. Working capital allows you to grow without compromising quality.

Imagine trying to:

- Expand your construction team while your accounts receivable are stuck in limbo.

- Open a second dental clinic without the cash to hire and train new hygienists.

No thank you.

With enough working capital, you’re not choosing between growing and surviving. You’re doing both—with confidence.

The Hidden Costs of “Winging It”

Some business owners try to fund growth with “internal cash flow” alone. That sounds great in theory, but in reality, it can mean:

- Delaying payroll or vendor payments

- Running dangerously low on reserves

- Losing momentum when unexpected expenses pop up (and they always pop up)

Translation: You’re one clogged pipeline, supply chain delay, or late client payment away from disaster.

Working capital financing creates a cushion, so you’re not constantly playing defense. You get to focus on growth, not survival.

When Should You Consider Working Capital Financing?

Spoiler: Before you’re desperate.

The best time to secure working capital is when you can be strategic—not reactive. If you’re planning any of the following, it might be time to explore financing options:

- Opening a new location

- Hiring new staff

- Taking on larger clients or contracts

- Investing in new technology or equipment

- Expanding into new markets or service lines

Don’t wait until you’re juggling overdue invoices and maxed-out credit cards to think about funding.

How BusinessFunds.com Makes It Simple

We know our audience—busy owners running lean, focused teams. Whether you’re in construction, healthcare, logistics, or any high-output industry, you don’t have time for red tape or unclear loan terms.

That’s why at BusinessFunds.com, we specialize in:

- Fast, no-nonsense approvals

- Transparent offers with no hidden fees

- Flexible financing that scales with your needs

We connect you to lenders who get your industry and offer terms that make sense—so you can focus on building, healing, creating, and growing.

Real Talk: Working Capital Isn’t Just About Survival. It’s About Confidence.

Having strong working capital means saying yes more often—to new clients, new hires, and big ideas. It means not sweating every payment cycle or asking “Can we afford this?” every time growth is on the table.

It’s a foundation—not a fallback. And if your business is gearing up to scale, that foundation has to be solid.

Final Thoughts: Expand Smarter, Not Harder

If you’re serious about growing your business, working capital isn’t optional—it’s essential. It gives you control, options, and peace of mind in an unpredictable market.

Need help finding the right loan to support your expansion? That’s exactly what we do.

At BusinessFunds.com, we don’t just connect you to capital—we connect you to opportunity.

Ready to grow without growing pains?

Let’s get started. Explore financing options or contact our team today for a custom plan that works for your business.